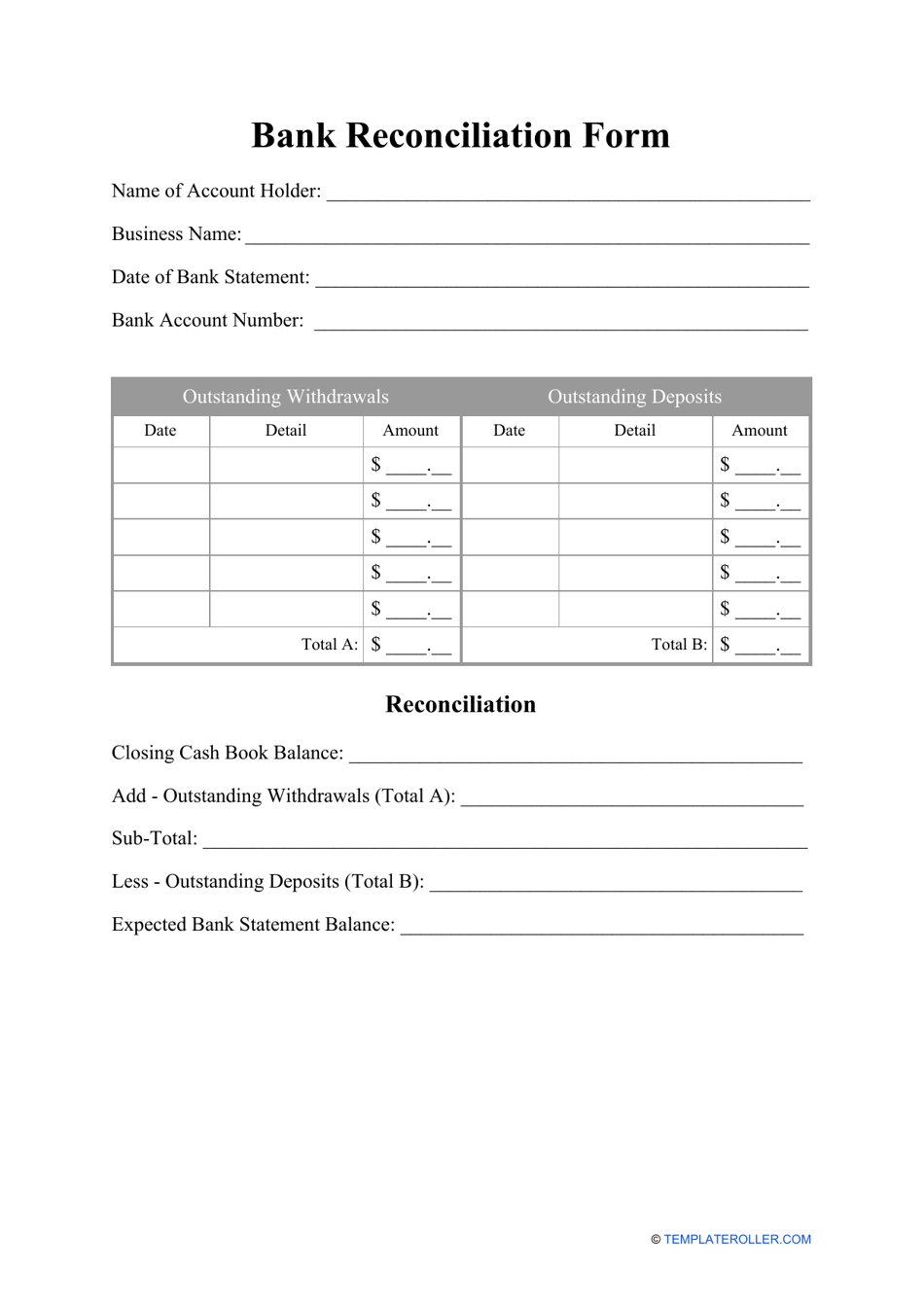

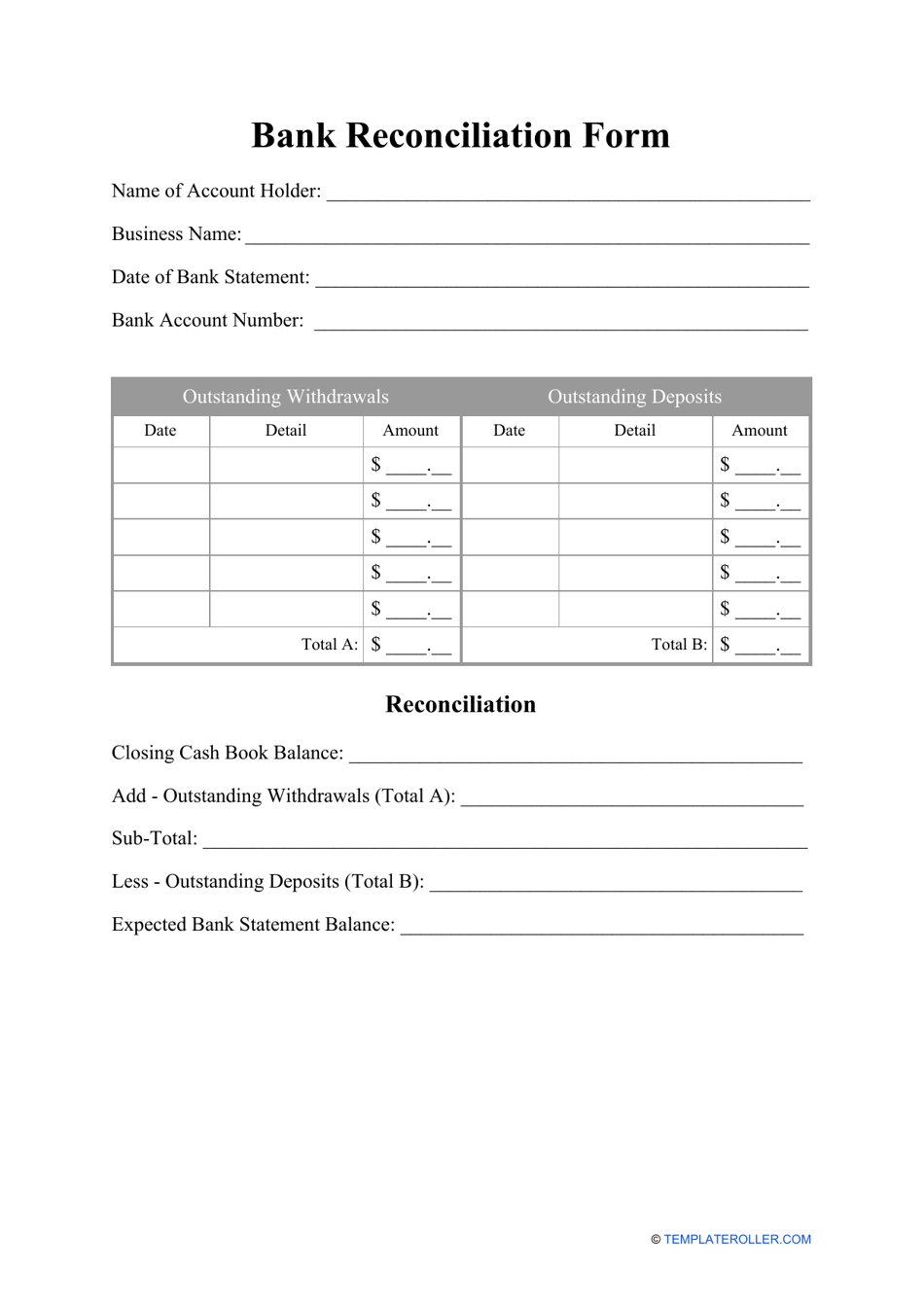

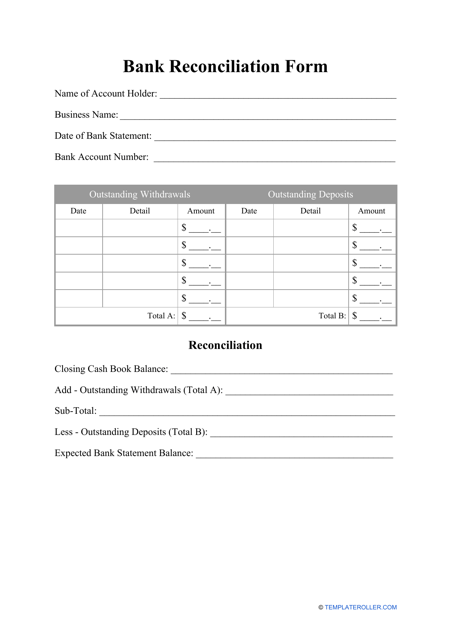

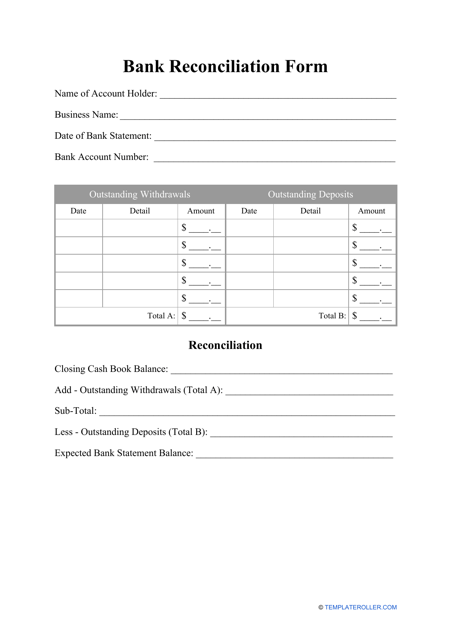

Bank Reconciliation Form

A Bank Reconciliation Form is an accounting document that contains the deposits and checks of an organization and allows comparing the remainder on an entity's balance sheet to the sum on its bank account.

The difference between the amounts on the indicated accounts is known as a "reconciling amount." The purpose of bank reconciliation is to:

- Reveal any failures in the bank account transaction system.

- Find any mistakes made by the personnel of the organization or bank.

- Maintain full accounting of all financial reports between the buyer and the seller.

- Ensure that the entity's cash reports are correct.

A company may prepare a Bank Reconciliation Form daily, monthly, or annually. This document is used in the bookkeeping and must be completed by an accountant of an organization. A printable Bank Reconciliation Form can be downloaded through the link below.

ADVERTISEMENT

How to Fill Out a Bank Reconciliation Form?

A Bank Reconciliation Form is used to implement a monthly verification and should be filled in as follows:

- The filer has to enter the date of completion and ending date of the bank account statement.

- Specify the remainder, indicated in the account statement.

- Indicate any deposits made since the closing date on the account statement in the outstanding deposits section. Specify the funds and receipts received and accounted for by your organization but not reflected in the account statement. Enter the total sum of outstanding deposits.

- Complete the outstanding checks section. Indicate any checks that were issued by the organization to creditors, but the payments were not processed. Indicate every check number and its amount. Enter the total sum of outstanding checks.

- List all open trust account ledger sheet balances in the trust ledger liability section. Indicate the transaction number, the names of the buyer or seller, and the corresponding balances. Enter the total sum of the trust ledger liability.

- The filer has to append the total sum of outstanding deposits to the bank statement balance and then deduct the total amount of outstanding checks. The result received represents the bank balance.

- The filer should enter the current balance from the Checkbook Register in the check register balance section.

- Enter the bank, open the ledger, and check the register balances. If the account is in a three-way balance, the indicated amounts should be equal, which means that they are reconciled. If there is a difference between these values, provide the difference and an explanation.

There are different ways to perform bank reconciliation. Instead of a 3-way reconciliation, you may implement it as a 2-way. In this case, the bank statement balance should be compared with the closing cash book balance for the last month. The bank statement balance must be calculated in the same way as described above. To estimate the closing cash book balance, enter the cash book balance from last month, add the full amount received for the month, and subtract the entire amount paid for the month. You can find these parameters in the cash paid analysis book. The filer must compare the remainder on the closing cash book balance and on the bank statement.

Still looking for a particular template? Take a look at the related templates below:

- Expense Report Template;

- Deposit Slip Template;

- General Ledger Template.

Download Bank Reconciliation Form

4.3 of 5 ( 27 votes )

ADVERTISEMENT

Linked Topics

Accounting Records Bookkeeping General Business Forms Business

Related Documents

- Expense Report Template

- General Ledger Template

- Bank of America Direct Deposit Form

- Chase Direct Deposit Form

- Monthly 3-way Reconciliation Form

- Petty Cash Reconciliation Form

- Pnc Direct Deposit Enrollment Form

- Bank Book Box Template

- Small Business It Risk Assessment Form - Vinton County National Bank

- Sick Leave Bank Leave Request Form - Lake County Schools

- Online Banking Application Form - First State Bank

- Internet Banking for Business Application Form - Citizens National Bank

- Debt Schedule Template - Community Bank of the Bay

- Etaxation User Enrollment Form - Grenada Co-operative Bank Limited

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.